Florida Produces 3rd Most Fruits and Vegetables in U.S.

November 24, 2021 | 4 min to read

Many sectors of the economy have struggled during the COVID-19 pandemic, but one of the sectors that has faced the greatest challenges in the U.S. is also one of the most critical: agriculture.

The early days and weeks of the pandemic were difficult for many agricultural businesses as shutdowns created major disruptions for some of their primary customers. Much of the food service industry shut down overnight in March 2020, drastically scaling back one of the primary sales markets for farmers. In response, more agricultural producers shifted their focus to retail grocery and wholesalers. However, they paid a steep price in the form of lost products and new costs in labor and logistics to adapt to different distribution channels.

Since then, agriculture has faced many of the same supply chain and labor challenges currently plaguing the rest of the economy. Supply chain breakdowns have meant that farms have been struggling to obtain supplies and equipment that they need and that it has become more difficult to transport their products to customers. Labor force participation remains below pre-pandemic levels, especially in low-wage occupations, which has contributed to a shortage of pickers and other agricultural workers. Because produce is perishable, these issues have caused millions of pounds of produce to go unharvested or spoil before reaching consumers.

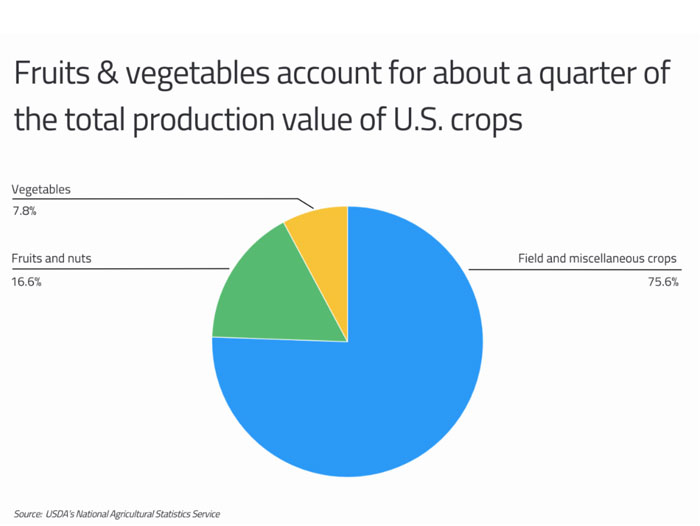

These disruptions pose a problem for consumers, who may have less ability to access high-quality fresh food at a low price, but also for the economy at large. Fresh produce in the form of fruits, nuts, and vegetables represents nearly a quarter of the total production value of U.S. crops. These products are also part of a larger value chain in the food industry that includes food processing plants, distributors, restaurants and other food service businesses, and grocery. This means that challenges in growing, harvesting, and supplying fresh produce creates additional struggles downstream for other closely related businesses.

|

These issues are also likely to affect what crops farms choose to grow and in what amounts. Because crops take time to raise, farmers essentially must make decisions in the present based on predictions about what the market might look like months in advance. With continued uncertainty, agricultural producers may prefer to shift more of their focus to crops that have higher value to improve their margins. In general, tree nuts and fruits tend to have higher production value than vegetables.

|

The current state of the agricultural market also underscores the importance of domestic agricultural production. In recent years, the U.S. has been importing a large share of its fresh and frozen fruits and vegetables, with imports totaling more than $24 billion in 2019. But with ongoing supply chain challenges worldwide, production closer to home will be important in maintaining the supply of food.

These fruits and vegetables come from a relatively small number of states where agricultural production is highly concentrated. The leader among these states is California, which is responsible for nearly 70% of U.S. fruit and vegetable production by itself. California is joined by other Western states like Washington, Oregon, and Arizona among the leaders, along with highly agriculture-dependent states in the South and Midwest.

The data used in this analysis is from the USDA. All data shown is for the year 2019, the most recent available covering both fruits and vegetables. To identify the states producing the most fruits and vegetables, researchers at Commodity.com calculated the total production value of both fruit and nut crops as well as vegetable crops, measured in dollars. Researchers also calculated what percentage of total U.S. fruit, nut, and vegetable production is accounted for by each state. Only states with available agricultural data from the USDA were included in the study.

The analysis found that in 2019, Florida produced $2.8B in fruit, nut, and vegetable crops. Out of the states with available agricultural data from the USDA, Florida produces the 3rd most fruits and vegetables. Here is a summary of the data for Florida:

- Total fruit & vegetable production: $2,759,462,000

- Share of U.S. total fruit & vegetable production: 6.52%

- Total fruit production: $1,536,612,000

- Total vegetable production: $1,222,850,000

For reference, here are the statistics for the entire United States:

- Total fruit & vegetable production: $42,326,702,000

- Share of U.S. total fruit & vegetable production: 100.0%

- Total fruit production: $28,770,303,000

- Total vegetable production: $13,556,399,000

For more information, a detailed methodology, and complete results, you can find the original report on Commodity.com’s website: https://commodity.com/blog/most-fruits-vegetables/