Meat Markets In The US – Industry Risk Rating Report – A New Market Research

June 17, 2010 | 3 min to read

Reportlinker.com announces that a new market research report related to the Meat and Poultry industry is available in its catalogue.

This is the replacement for IBISWorld's August 2009 edition of Meat Markets in the US Industry Risk Ratings Report.

Industry Risk Ratings Synopsis

This Industry Risk Ratings report from IBISWorld evaluates the inherent risks associated with the Meat Markets in the US industry. Industry Risk is assumed to be 'the difficulty, or otherwise, of the business operating environment'.

The report looks at the operational risk associated with this industry. Three types of risk are recognized in our analysis. These are: risk arising from within the industry itself (structural risk), risks arising from the expected future performance of the industry (growth risk) and risk arising from forces external to the industry (external sensitivity risk).

This approach is new in that it analyses non-financial information surrounding each industry. Industries are scored on a 9-point scale, where 1 represents the lowest risk and 9 the highest. The Industry Risk score measures expected Industry Risk over the coming 12-18 months.

Industry Definition

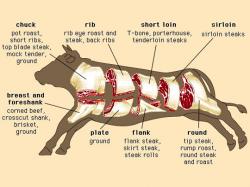

Meat markets or delicatessen type establishments are involved in the retail of fresh, frozen or cured meats and poultry. Beef, pork, lamb, chicken and turkey meat are sourced from wholesalers and sold directly to households at markets, butcher shops and delicatessens.

Report Contents

Risk Overview

The Risk Overview chapter includes sections on Industry Definition and Activities, Industry Risk Score and Risk Rating Analysis. The Industry Definition and Activities section provides a detailed definition of the activities carried out by operators in this industry as defined in NAICS. A list of the primary activities of the industry is also included. The Industry Risk Score section provides the Overall Industry Risk Score as well as the Risk Scores for each of the three types of risk covered that combine to form the Overall Industry Risk Score. These three types of risk are Structural Risk, Growth Risk and External Sensitivity Risk. The Risk Rating Analysis section discusses the underlying factors contributing to the Overall Industry Risk Score.

Structural Risk

The Structural Risk chapter looks at risk arising from within the industry itself and provides a detailed discussion of the industry’s level of exposure to seven key indicators. These key indicators are Barriers to Entry, Competition, Industry Exports, Industry Imports, Level of Assistance, Life Cycle Stage and Volatility of Industry. The Overall Structural Risk Score is a weighted aggregation of these seven key indicators. Each of the key indicators is discussed in detail in this section.

Growth Risk

The Growth Risk chapter looks at risks arising from the expected future performance of the industry. The Overall Growth Risk Score is determined by amalgamating the scores for Recent Industry Growth and Forecast Industry Growth. Detailed analysis is provided discussing the reasons for the growth scores of both.

Sensitivity Risk

The Sensitivity Risk chapter looks at risks arising from forces (sensitivities) external to the industry. The Overall External Sensitivity Risk Score is determined by identifying the most significant (up to 6) external factors and weighting them to represent how significant each sensitivity is to the performance of the industry. Examples of External Sensitivities are Exchange Rates, Interest Rates, Commodity Prices and Government Regulations. There is also a detailed analysis of the affect each of the sensitivities has on the industry, including charts and data tables where appropriate.

Industry Risk and Industry Risk Scoring Methodology

This chapter provides an overview of how IBISWorld defines Industry Risk and discusses the methodology used to arrive at an Industry Risk Score. There is also a table that provides a definition of the seven levels of Industry Risk.

44521 – Meat Markets in the US

(rlk1-2010-06-17) plp

RISK OVERVIEW

Industry Definition and Activities

Industry Risk Score

Risk Rating Analysis

STRUCTURAL RISK

Barriers to Entry

Basis of Competition

Domestic and International Markets

Industry Assistance

Life Cycle

Industry Volatility

GROWTH RISK

Recent Growth Analysis

Forecast Growth Analysis

SENSITIVITY RISK

Population Growth Rate

Per Capita Disposable Income

Domestic Price – Livestock Products – Meat

Competition from Substitutes – Supermarkets and Grocery Stores – Meat Markets

Nutrition – Total Meat Consumption

INDUSTRY RISK AND INDUSTRY RISK SCORING METHODOLOGY

What is Industry Risk?

The Industry Risk Scoring Methodology

Risk Rating Score Definition

Source: IBISWorld