Hindsight 2020: Retail and Foodservice Trends Through The Pandemic

April 2, 2021 | 2 min to read

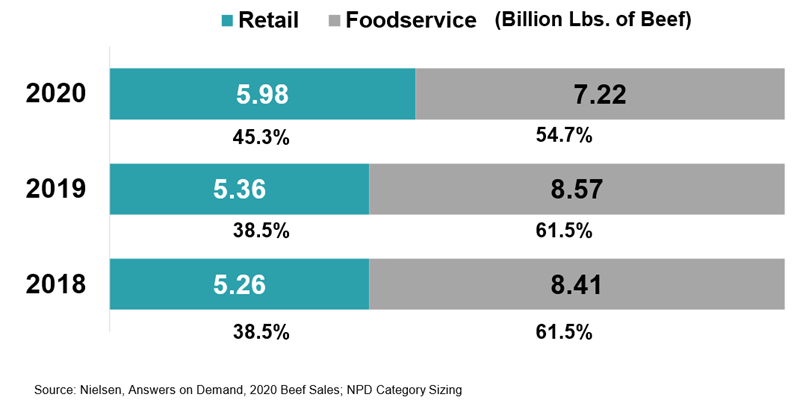

A year into one of the largest disruptions of the global and U.S. economies, some industries and market sectors are continuing to feel the severe impacts of COVID-19. One of the largest industries in the U.S. to continue struggling due to the impact of COVID-19, the foodservice industry, comprises the majority of consumer beef demand in the United States on an annual basis. About 60% of annual beef demand is consumed at restaurants, schools, entertainment venues, and other non-retail locations1; this past year, grocery stores experienced a demand shock from increased shopper activity and temporary supply deficits. While the increased demand and the impacts of COVID-19 temporarily led to supply constraints during the summer, the retail industry rebounded well for the remaining months of 2020.

A major change in consumer behavior that affected the retail industry was the “stocking-up” behavior experienced at the beginning of the pandemic. Shoppers rushed to their grocery stores to buy surplus groceries, especially meat products. Even as late as September of last year, 50% of consumers surveyed reported to be “stocking-up” at a greater rate than normal.[i] With this behavior, and with the foodservice industry restricted or shutdown, 83% of consumer meals were being cooked and consumed at home.2 Ground beef was one of the main products to be stored in refrigerators and freezers, with over 50% of consumers reporting to have surplus ground beef products.2

To read the rest of the story, please go to: The Beef Checkoff