For Beef, Is Perception Truly Reality?

September 8, 2017 | 2 min to read

The following commentary is provided by Polly Ruhland, Cattlemen's Beef Board CEO

When deciding what protein to eat, today’s consumer is still looking for a tasty experience, and beef is delivering.

The Consumer Beef Index (CBI) is a key research survey your checkoff fields twice a year with 1,000+ consumers. It is conducted to:

- Track changes in consumers’ perceptions of and demand for beef relative to other meat proteins, particularly chicken, its primary competitor.

- Assess the impact of the beef industry’s communications efforts on consumer attitudes and behaviors.

- Measure the extent to which consumers consider the positive aspects of beef to outweigh the negatives.

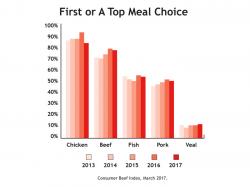

Results from the spring wave of the study showed 77 percent of consumers noted beef was their first choice, or a top choice when it came to proteins, and 93 percent noted eating beef at least monthly; both very strong results.

That said, we have seen the weekly frequency of beef consumption decline. There is less beef available on a per capita basis than in the year 2000, but while that has changed in the past two years, the perception by consumers is that beef prices are higher so they are eating less beef.

The CBI helps your checkoff understand why the consumer thinks they are eating less beef, and address those concerns through advertising campaigns, social channels and in grocery stores. We are seeing ongoing concerns about nutrition – nutrition is important to the consumer in making that dinner decision. More people are saying, “I think there’s something else out there that’s healthier,” but they aren’t calling out saturated fats or heart health specifically as they did in the past. And, beef lags chicken on value in the consumer’s mind.

We are seeing positive upswings about beef’s taste, safety, and knowing how to cook with beef. Within the CBI is a second tracker, the Consumer Image Index, that asks about perceptions on how cattle are raised. Sustainability wasn’t even on the radar five years ago, but it certainly is a factor today. Through a series of deeper-dive questions in the Consumer Image Index, consumers revealed they like the age-old traditions, such as the heritage of beef producers; but they also like to know we have the most cutting-edge animal care practices in place. This information from the study reinforces the need to humanize our industry and document how our industry has progressed. And we need our story to be out there.

We are producing the best product we’ve ever produced. And consumers love it. That’s not perception, that’s reality!

You can read the full CBI here.

For more information about your checkoff investment, visit MyBeefCheckoff.com.

Source: Beef Checkoff Program