Did You Know.. Fed Cattle Prices And This Thing Called Demand

October 5, 2015 | 3 min to read

A year ago, talk around the coffee table had one rancher telling how he got $3/lb. for his calves and another said he sold his for more than $1,500/head, a price he was sure he’d never live long enough to see.

They chatted more, reflecting on how much this market had improved in the last five years, and all agreed the consumer must really like beef. They sure kept buying it, so that thing economists call beef demand must be the real deal.

One of the old timers reflected on the 1980s and ’90s, when that demand was really taking a beating – it was a good thing the industry got the message and started producing a higher quality product, he said.

Yes, we all can agree that tighter beef supplies from reduced cattle numbers, while exports grew and domestic consumers kept buying, led to amazing cattle prices. Even more amazing, consumers stayed hooked on beef in the face of great buying opportunities for other proteins.

OOPS… 10 months later as summer gave way, a dramatic fall occurred: The 30% decline in fed cattle prices was of a magnitude not seen in at least 40 years, and never so great a decline in dollar values.

Precipitous declines usually go with some catastrophe like BSE in 2003 or a bust in the stock market like 2008, but nothing remotely analogous to that was going on.

Had this nebulous thing called beef demand just fallen in the tank?

As much as we have tried to understand it, we have to be honest and admit there are too many factors involved to know everything about it.

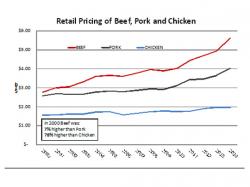

Sure, there are things about beef demand we DO KNOW. Given a protein choice, consumers much prefer beef, willing to pay a much higher price for it even during periods of tight budgets (see graph).

We DO KNOW retail ad featuring has a great impact on beef sales (demand) and in spite of limited featuring in recent years, beef sales have continued strong. We also know beef is still king at upscale restaurants, where demand is brisk, especially for the premium beef brands and grades.

So to find answers, let’s look at what you likely DID NOT KNOW about beef demand.

Tanya Mark, marketing and consumer studies professor at the University of Guelph in Ontario, shared some results of recent research that send a strong message to the beef industry.

What initiated Mark’s study was that a premium beef brand showed amazing growth during the 2008-’09 recession while other consumer items suffered considerable declines in sales.

Her work showed the premium brand fell into a consumer classification called hedonic consumption – there is such a strong desire for the pleasure that the consumer will buy the product at the expense of some other premium items they also desire.

Fortunately, high-quality beef in general falls into that category, which bodes well for the beef industry. That’s because based on tonnage of Choice, Premium Choice and Prime, we’re probably producing the highest quality beef ever.

Professor Mark also studied the role of brands using a classification called “cross-category indulgence.” For example, if a shopper wants to buy a handbag of an elite brand but feels she cannot afford it, she will realize a smaller purse of the same brand will satisfy her desire for a pleasurable purchasing experience.

Using beef in that scenario, the consumer may really want a filet mignon, but realizes she can only afford a top sirloin – but staying in the same brand category, they still have a satisfying dining experience.

Sustained demand for high-quality beef is further supported by work at Kansas State University by ag economist Ted Schroeder and Lance Zimmerman, a current Cattle-Fax analyst. Their model tracks demand changes for Certified Angus Beef ® brand versus low Choice, showing in 12 years from 2002 to 2014, CAB demand grew 96.5%, compared to only 2.3% for low Choice.

After sharing that work at the recent CAB annual conference, the brand’s president, John Stika noted record sales in 7 of 12 months in fiscal 2015. Amazingly, during that brutal decline in cattle prices this September, CAB experienced its highest sales volume ever for that month. Those 78 million pounds lifted CAB annual sales to a ninth record year, at 895 million pounds.

As we experience these drastic price declines, let’s keep some perspective. From 2011 to 2015, the price of end meats increased from $2.89 to $4.19(45%), middle meats $6.39 to 7.96 (25%) and grinds in ad features went from $1.98 to $4.99 (152%). Yet the consuming public continued to buy beef at these record prices.

Bottom line: There is no evidence that consumer demand has waned. Retail stores will start running more beef ad features, and beef will re-establish more logical price thresholds.

Source: Certified Angus Beef ®