2024 Beef Market Outlook

January 19, 2024 | 2 min to read

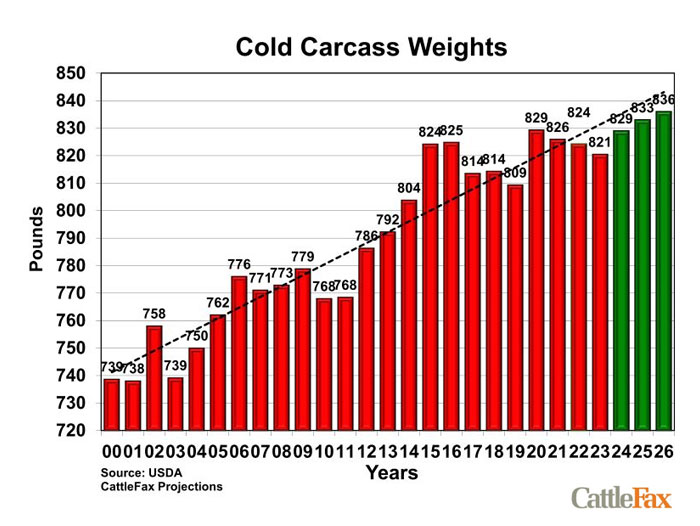

As 2024 unfolds, the cattle and beef markets are anticipated to face reduced supplies and stronger prices, with the beef cow herd yet to rebuild. Although feedyard inventories are currently above last year's levels, they will likely become tighter later in the year. Slower marketing rates and less aggressive procurement by the packing sector will contribute to elevated steer carcass weights, which may remain high into spring, pending winter feeding conditions and potential adverse weather effects.

As 2024 begins, only time will tell what exactly the year has in store for cattle and beef markets, but reduced supplies and firmer prices are expected to be major trends. The rebuild of the nation’s beef cow herd has yet to begin, leaving tighter cattle numbers and beef supplies ahead.¹

The reduction in cattle and beef supplies in 2024 is likely to come unevenly across the year, with supplies relatively more adequate early and tighter later. In terms of fed cattle supplies, the year begins with feedyard inventories above year-ago levels.² However, those inventories are likely to be spread out over the first half of the year. Feedyards are expected to slow the marketing pace as low costs of gain compared to selling prices encourage added weight, compounded by historically wide quality grade spreads in the boxed beef complex. Moreover, narrower packing margins will provide less incentive for the packing segment to aggressively procure cattle, slowing throughput and capacity utilization.

The impacts of a slower turnover rate have already been seen at the close of 2023 with steer carcass weights pushing to record highs and as much as 22 pounds above year-ago levels (USDA AMS). ³,⁴,⁵ Carcass weights are expected to follow the typical seasonal pattern of declining into the spring and early summer but are likely to remain large due to the market dynamics described above. Combined with relatively adequate harvest numbers, the added tonnage will further moderate declines in beef production through early 2024. The biggest question will be winter feeding conditions as recent storms and potential for further adverse weather could slow cattle performance and cause a more precipitous seasonal decline in weights.

To read the rest of the story, please go to: The Beef Checkoff