NPD: Q2 Continues Four-Year Streak Of Full Service Restaurant Visit Losses

October 3, 2012 | 2 min to read

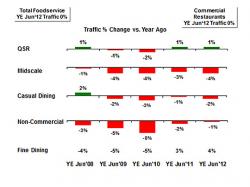

Chicago — Consumers pulled back from visits to midscale and casual dining restaurants in the April, May, and June quarter continuing a four-year streak of visit losses for the full service segment, according to The NPD Group, a leading market research company. The +1 percent growth in quick service restaurant (QSR) traffic compared to the same period last year offset the full service losses to keep total industry traffic stable in the second calendar quarter, reports NPD’s foodservice market research.

Foodservice eater checks rose an average of +2 percent in the second quarter despite slowed traffic growth, according to NPD’s CREST®, which continually and rigorously tracks the foodservice industry based on consumer reporting of over 400,000 visits to foodservice outlets a year. The check increase for the past two quarters lagged behind inflation for food away from home (+2.9 percent), but it was still the strongest rate of increase in over two years. Although some of the check increase can be attributed to price increases, foodservice visits on a deal were soft and full-priced visits posted growth, which would also drive checks up.

Consumers spent more in the second quarter, but it appears that price points come into play when consumers are choosing restaurants. With the $9.66 average check at midscale nearly twice that of QSR ($5.18) and casual dining at $13.31 two and a half times QSR’s average check, consumers may feel they have some room to experiment with QSR offerings. Price and affordability are key influences on consumers’ restaurant behavior but so are value, food quality and service, according to NPD’s recently released report, Casual Dining Restaurants, Stop the Leaky Bucket, which examines customer motivations for selecting restaurants, cross purchasing and customer satisfaction to help full service restaurants increase visits.

Visits to casual dining restaurants declined by -2 percent in the quarter compared to the same quarter last year and midscale traffic dropped by -3 percent. Traffic to non-commercial outlets continued to contract for the quarter with a -2 percent decline, which was driven by losses in foodservice visits to business and industry and to the education sector. Visits were up at all the QSR main meals while midscale restaurants absorbed traffic losses throughout the day. Casual dining supper, the segment’s most important daypart and the one that garners the highest check, was weak, while lunch, the next important daypart, was stable.

“In our forecast for the balance of 2012 and 2013, the foodservice industry’s growth is likely to depend on check increases with traffic remaining relatively flat,” says Bonnie Riggs, NPD’s restaurant industry analyst. “An improvement in the economy, especially reducing unemployment, would certainly help the industry improve.”

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 2,000 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, entertainment, fashion, food, home and office, sports, technology, toys, video games, and wireless. For more information, contact us, visit http://www.npd.com/, or follow us on Twitter at https://twitter.com/npdgroup.

Source: The NPD Group, Inc.