Leading Fast Casual Restaurant Chains Not Only Weathered the Economic Storm, They Prospered, Reports NPD

March 16, 2011 | 2 min to read

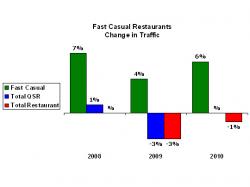

Chicago Visits to the leading fast casual restaurant chains grew 17 percent over the last three years while the rest of the industry experienced its steepest traffic declines in decades, and consumer demand for fast casual offerings exceeded the unit growth of leading fast casual chains, according to foodservice market research by The NPD Group, a leading market research company.

As defined by NPD, fast casual restaurants are upscale quick service restaurant concepts that offer more service and higher quality food, and have a larger average check size than other fast food restaurants. According to NPD’s CREST®, which continually tracks consumer usage of foodservice outlets, for year ending December 2010, visits to the leading fast casual restaurant chains, like Chipotle, Five Guys Burgers and Fries, Noodles & Company, and Panera, were up +6 percent for year ending December 2010 versus a year ago. This compares to a -1 percent decline in total industry visits for the same time period. Over the last three years fast casual traffic has grown by 17 percent.

“Fast casual restaurants have done an excellent job of satisfying their customers’ needs for quality and service and have built strong customer loyalty as a result,” says Bonnie Riggs, restaurant industry analyst at NPD. “The attributes that define the fast casual concept fresh, food quality, and service are the reasons why customers give them their highest satisfaction ratings.”

Responding to growing consumer demand the major fast casual chains grew units by a double-digit rate over the last three years. Even with this unit growth, demand outpaced the rate of unit development, reflecting consumer satisfaction with the fast casual experience. Since 2007, fast casual unit availability expanded 12% and traffic has grown by 17%.

According to NPD’s A Look into the Future of Foodservice, which provides a ten-year forecast of foodservice trends based on aging, population growth, and trend momentum, demand for fast casual restaurants will grow significantly over the next decade. Incremental traffic for fast casual will source to teens and young adults – particularly those 10-30 years of age (Generation Z) – and to a lesser extent, those 55 years+. By 2019, generation Z will be the single largest population group at 90 million strong.

“Fast casual concepts are in an excellent position for growth. We’ve seen other fast food customers trading up to fast casual and full service customers trading down to fast casual,” says Riggs. “In addition, with imitation being the highest form of flattery, we’re now seeing other segments of the industry duplicate what has made fast casual concepts so successful.”

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information contact us, visit http://www.npd.com/ or find out more about NPD’s foodservice market research by visiting www.restaurantindustrytrends.com

Source: The NPD Group, Inc.