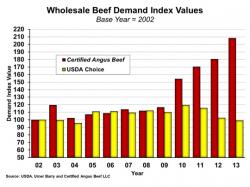

Demand For CAB More Than Double The 2002 Level

May 21, 2014 | 2 min to read

A consumer demand model for high-quality beef shows the market power behind a leading premium brand.

The Kansas State University (K-State) model uses 2002 as an index base and charted demand for commodity USDA Choice beef near the 110 level for most of the following years. It jumped to 120 in 2010 before eroding for the past three years and last year falling below 100 for the first time since 2004 (see chart 1).

Consumers apparently turned toward a premium brand, according to the K-State paper, “Defining and Quantifying Certified Angus Beef ® (CAB®) Brand Consumer Demand,” which can be viewed at www.cabpartners.com/research. The CAB index shot upward for the past four years to more than double the index, surpassing 208, compared to the 100-point base.

Economist Ted Schroeder and 2010 Master’s student Lance Zimmerman conducted the initial study that year and updated the paper in 2013.

Zimmerman, now a CattleFax analyst, continues to update his college project as new data becomes available, and recently added the 2013 information.

The charts were expanded a year ago to include a CAB comparison to demand for all premium beef, which eclipsed that for the brand for seven years but fell behind in 2012 and 2013 (see chart 2).

The recent “divergence of demand patterns… suggests there are perceived differences in CAB relative to its greater product category in the mind of consumers,” the paper says.

When compared to Choice and higher, to include Prime and branded premium beef, CAB demand has seen a 54-point increase in four years, compared to a 29-point drop for the category in general. In fact, CAB demand jumped nearly 28 points in the single year 2012-13.

Demand for CAB increased by more than 108% in the last 10 years as Choice-and-higher beef demand grew by 51% and demand for non-branded commodity Choice fell by 1%, based on amounts sold rather than produced.

Source: Certified Angus Beef LLC