Breakaway Demand For A Premium Beef Brand

June 1, 2016 | 4 min to read

The 2016 cattle market has disappointed many sellers, especially those only focused on more pounds or efficiency.

Quality has played an increasingly key role since the “Great Recession” in 2008, and it promises the most stability going forward says CattleFax analyst Lance Zimmerman. Six years ago as a graduate student at Kansas State University, he and economist Ted Schroeder created a demand model that stretched back to 2002.

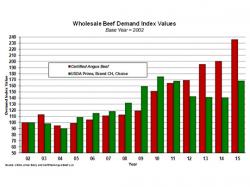

Updated with 2015 beef sales data, the model shows a third year of modest growth for Choice demand and the strongest growth to date for the Certified Angus Beef ® (CAB®) brand. The 927 million pounds licensees sold worldwide in 2015 was a 5.7% increase in the face of record-high prices.

That added 35.65 index points to reach 236.16 on the 100-point base, for a 136% increase since 2002 and 11 consecutive annual increases. Choice demand was up nearly 9 points, its best showing since 2005 but still near that original base (See Fig. 1).

Zimmerman notes exact numbers shifted from past reports because of changes in a related government Producer Price Index, “but year-to-year historical demand trends did not change.”

A quick glance at the bar charts could bring skepticism. How can demand for CAB continue growing at such a rate?

Dedicated staff and targeted training for the brand’s 16,000 partners around the world explain some of that, Zimmerman says. It could also explain why demand for CAB has outpaced that for other premium beef since 2011 (See Fig. 2).

“Commodity Choice and even Prime beef markets rely on the industry as a whole,” he says. “Nobody is even looking at what percentage of each carcass is sold as Choice or Prime, and that’s true of most other beef brands.”

The CAB team approach to marketing monitors shifting supplies and initiates strategies to “find a home for more product when it shows up on the radar,” Zimmerman says. “Everyone is focused on marketing as much as possible of each carcass as branded product.”

That does not mean demand always goes up; it fell back in 2004 when international trade was rocked by the discovery of bovine spongiform encephalopathy in North America. And some years, demand for CAB showed only a slight gain.

Schroeder says CAB makes a good case study in demand because of available data on a well-defined market segment.

“Year-over-year demand for CAB has increased at a remarkably robust rate in the last several years,” the economist says. “Consumer preference is driving a wider and wider price wedge

between a high-quality-assured product and the less well-articulated beef eating experience that may carry more uncertainty.”

Demand is an intersection of quantity and price, which can be represented as a mark for each period of time measured on a “scatter gram.”

“How much are you willing to buy and how much are you willing to pay? The scatter gram just illustrates the answers,” Zimmerman says.

The mark for each year is an average of a concave trend line, each differing but generally curving higher on the left. That’s because higher prices tend to result in smaller quantities demanded.

A scatter gram for CAB demand over time shows the setback in 2004 and recovery every year since, albeit small steps from 2006 through 2009 (Fig. 3). Those were followed by breakaway higher demand in 2010 and 2011 and again in 2014 and ’15 after a couple of years with small gains.

“Prices generally moved higher across most of those years, so demand was working atypically,” Zimmerman says. He explains the quantity demanded is in terms of world consumption “because wholesale beef price is an implied global price.”

Indeed, he says the global market of a billion more people since 2002 is growing in importance as the per-capita supply for U.S. consumers continues to decline.

“That’s not connected to demand, but rather a shift in supply,” Zimmerman says. “We’ve gone through a cow herd reduction and now as we expand, we’re sending more of our product overseas. The 11% exported in 2014 was an all-time high mark.”

CAB President John Stika notes the brand sent a record 14% of its growing supply to international markets that year, selling the same tonnage last year and growing at nearly 2% through the first half of 2016.

“That’s despite several disadvantages in currency exchange rates,” he says. “Overall brand sales are growing at a 12% pace through spring – led by retail at 22% – which seems likely to move the demand curve higher again this year.”

Another global recession could occur in the near future, Zimmerman says. “Just based on history, we are due, but CAB demand has only grown since the last recession.”

Schroeder, noting higher premiums also paid to producers for the CAB brand since then, points to the source of demand.

“The premium and prosperity for those producing high-quality beef starts at the consumer level in every market,” he says. “That consumer drives what happens on down the supply chain to the ranch.”

Source: Certified Angus Beef LLC